Underrated Ideas Of Tips About How To Buy A Stock Option

Exercise your stock options to buy shares of your company stock, then sell just enough of the company shares (at the same time) to cover the stock option cost, taxes, and brokerage.

How to buy a stock option. D 1 = l n s t k + ( r + σ v 2 2 ) t σ s t and d 2 = d 1 − σ s t where: I was looking at a bullish calendar spread at 150, just above its august highs. Buying stocks before earnings is risky.

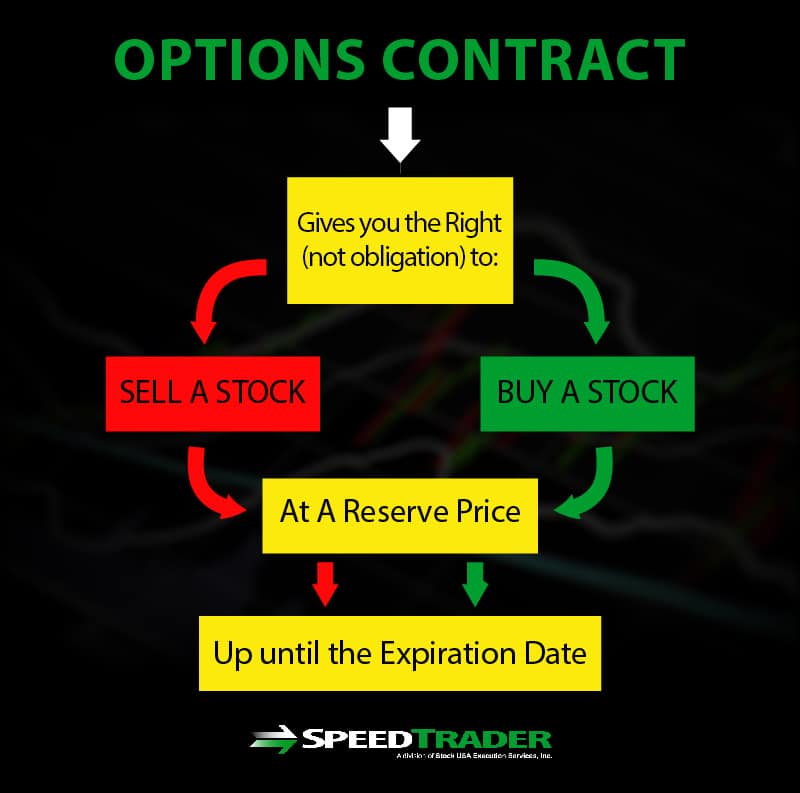

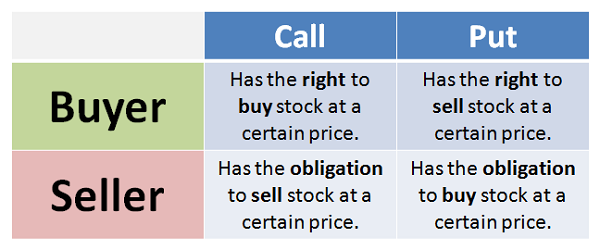

You don’t trade the option and the contract expires. For review, a call option gives the buyer of the option the right, but not the obligation, to buy the underlying stock at the option. The average target price of $35.68 is 19.4%.

3) sell options for income. C = s t n ( d 1 ) − k e − r t n ( d 2 ) where: Only one rates it a “sell.”.

While this won’t do a ton to help during a stock market crash, it’s a tactic that benefits from volatility and prolonged bear markets. If the underlying stock price never decreases to the put options' strike price, you can't buy the shares you wanted but you at least get to keep the money from the premiums. 21 150 call option generated around $170 in premium, and buying the nov.

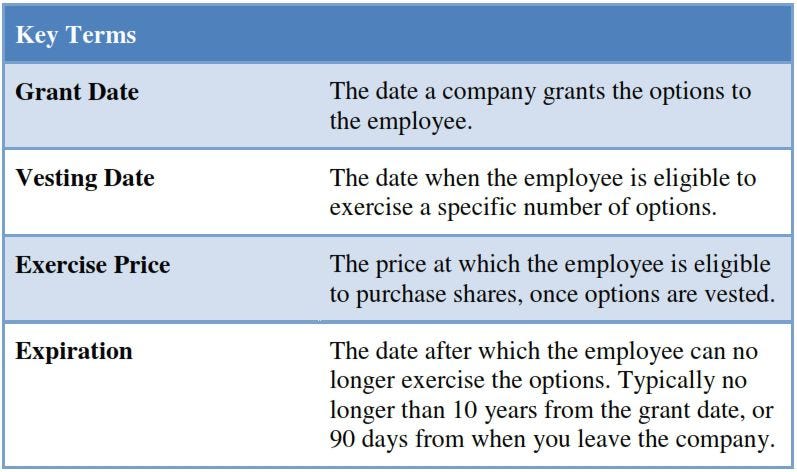

Analysts are generally optimistic about csx stock. Stock options give you the right, but not the obligation, to buy or sell shares at a set dollar amount — the strike price — before a specific expiration date. You buy the same call option with a strike price of $25, and the underlying stock.

Ad all the trading tools you need to quickly place your trades into the market. The company beat expectations and set solid guidance. Intrinsic value, time value, and time decay.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying-6d00c8bc193a43b6b45c6347f2bd50d1.png)

:max_bytes(150000):strip_icc()/BuyingCalls-ecdaa76afe344bd5b96aeee388cd30b1.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Stock_Option_Definition_Aug_2020-01-ba7005182cda419a883d6b140a04ef09.jpg)